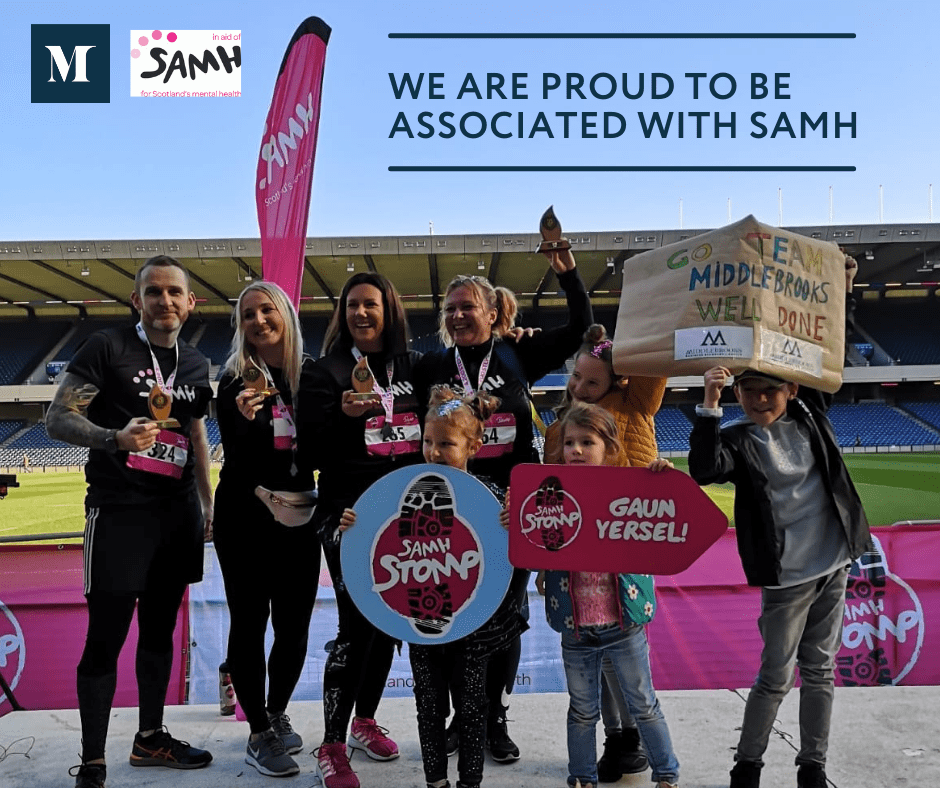

At Middlebrooks, supporting the health and well being of our team members and clients is an integral part of our ethos. This year, we will be working hard to raise awareness and support the initiative in collaboration with SAMH (Scottish Association For Mental Health).

It is our vision to help our clients in financial distress and work towards a positive outcome together. We are mindful of the sensitivity that comes with financial stress and we try to interact with every client showing complete compassion & empathy.

Our clients can need our services for varied reasons, whether it is winding up a company, or deferred creditor payments or filing for bankruptcy along with company restructuring & advisory services.

Each of these situations, brings along a bag of overwhelming emotions. Luckily, they are not alone. Middlebrooks, being a small boutique company, has the ability to cater to each client and situation with a personalised approach.

Since the pandemic, there’s never been a more poignant time to talk about mental health.

With SAMH, our main priority is, and will continue to be, making sure our colleagues & clients are safe and well. By protecting the welfare of our clients, by having regular communications with them and by educating them, we’ve been able to maintain our vital services for customers and adapt to meet the needs of the current situation.

We know we need clear lines of available support, we need to work as flexibly as possible, be resilient and find new ways to stay connected.

If you find yourself becoming overwhelmed by the stress of bankruptcy or any other financial stress, talk about it with trusted loved ones and friends, professionals, and definitely your accountant. So long as you prioritize your mental health and remain productive, your situation can make a turnaround for a positive and stress relieving experience.